Economic Integration and Sustainability

Research:Seminars/Workshops

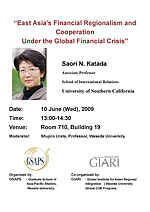

“East Asia's Financial Regionalism and Cooperation Under the Global Financial Crisis”

Lectured by Saori N. Katada

2009.06.10

East Asia

“East Asia's Financial Regionalism and Cooperation Under the Global Financial Crisis”

“East Asia's Financial Regionalism and Cooperation Under the Global Financial Crisis”Saori N. Katada

Associate Professor

School of International Relations, University of Southern California

Date: 10 June (Wed), 2009

Time: 13:00-14:30

Venue: Room 710, Building 19

Moderator: Shujiro Urata, Professor, Waseda University

Language: English

Admission free, No-preregistration

Organized by: GSAPS(Graduate School of Asia-Pacific Studies)

Co-organized by: GIARI(Global Institute for Asian Regional Intgration)

Saori N. Katada

Summary

Number of Participants:

37Summary of the Presentation

Dr. Katada discussed East Asia's financial cooperation and the on-going global financial crisis. Her lecture focused on the origin and development of the regional financial cooperation in East Asia, impact of the global financial crisis on the region, and the prospects for the cooperation in the future.

First, Dr. Katada discussed the progress of East Asian financial cooperation including multilateralization of Chiang Mai Initiative. She argued that such achievement has been significant, because of its rapid development after the Asian financial crisis, and exclusion of the United States from ASEAN+3.. This regional financial cooperation is also quite different from that of European integration, because it developed quite independence from regional trade or investment arrangements.

Second, Dr. Katada discussed the origin and development of financial cooperation in East Asia. By citing the existing work by other researchers, she listed various perspectives as to how the region's leaders became interested in the regional financial cooperation. For example, at the time of the 1997-98 Asian financial crisis, the leaders in the region felt threatened by their countries' excessive dependence on the foreign capital and feared negative side effects from the IMF involvement, whose policies reflected so-called “Washington Consensus.”East Asian governments came to look for ways in which they can collectively secure regional financial stability and fair treatment by the international financial institutions, and prevent prospective financial crises from negatively affecting the region. After outlining such motivation, Dr. Katada illustrated, with charts, graphs and diagrams, how East Asian financial cooperation developed, and demonstrated financial significance of such developments.

Dr. Katada then turned her discussion to the current global financial crisis and its impact on East Asia. She referred to “global imbalance” between East Asia and the United States as a background of the global financial crisis in question. Massive capital inflow from high-saving East Asian countries such as China and Japan into the United States stimulated the US economy leading to reckless financial ventures including securitization of subprime mortgages, whose collapse resulted in the global financial crisis. As a consequence, East Asia suffered significantly. Dr. Katada clearly illustrated with her data and graphs how the economic downturn in the United States and Europe was transmitted through trade, financial and exchange rate channels.

As for the global and regional reaction to the current financial crisis, Dr. Katada pointed out that East Asian countries resorted to both regional arrangements such as “+3” meeting (China, Japan and South Korea), the EMEAP and ADB, and to unilateral method including fiscal stimulus packages. They have also supported emerging new global forum such as the newly established Financial Stability Board, whose policies reflects the agreements at G20 meetings.

To conclude, Dr. Katada summarized challenges and opportunities for regional financial cooperation in East Asia. According to Dr. Katada, lack of sufficient ties among the countries in the region imposes challenge to East Asia. Even the most institutionalized CMI has its challenges: South Korea did not turn to CMI at the time when it faced currency downturn in October 2008, because it was wary of the CMI's IMF link. Nevertheless, the fact that East Asia managed to escape the worst of the crisis, and de facto multilateralization at CMI both demonstrate how far East Asia has come, and those illustrate the opportunities that such regional cooperation presents. For further prospects, she pointed out that globally the IMF reform and decentralization of financial policy‐making initiatives on the global scale would give Asia more leverage, and within the region, development of Asian bond market comprises a key towards further development of financial stability in East Asia.

Summary of the Q&A Session (Questions)

Q.1:

Is decoupling, or the combination of less extra-regional economic and financial dependence and more intra-regional economic and financial integration, an important policy goal for East Asian countries right now?

A.1:

Decoupling solely should not be the goal, since that could lead to East Asia's position in favor of regional protectionism. Furthermore, it is very hard to accomplish the complete decoupling in the first place.

Q.2:

How should East Asian countries respond to the global financial crisis through fiscal imbalance? Should the government rely on issuing bonds or raising certain kinds of taxes?

A.2:

It depends on the magnitude of policy implementation, but taxation is generally more risky and can even worsen domestic economic crisis. Bond is often safer than taxation.

Q.3:

How do you evaluate the sovereign bond as a method to finance government expenditures?

A.3:

Resorting to the sovereign bond is indeed a risky way to raise revenue, but it is a question of magnitude of dependence on it and its sustainability. Nevertheless, bond is generally less risky than sovereign borrowing through syndicate loans.

Q.4:

Did the “global imbalance” that Prof. Katada mentioned in the presentation really the cause of the global financial crisis?

A.4:

The global imbalance is not the immediate cause but rather a background of the crisis. However, it is true that East Asia mostly benefited from the US role as a large buyer, which led to the global imbalance in question

Photos